Process Of Refinancing A Car

The process of refinancing vehicles is actually fairly straightforward. It works in a similar manner to the original purchase. However, unlike haggling about the value of the vehicle, you are locked into the cost associated with the original purchase. Essentially, the new lender buys your debt and then lends that amount to you, typically at a lower rate and with an improved term.

There is some key information to gather before taking the leap. Approach the lender and discuss the interest rates available, along with any fees you will be expected to pay. Find out if there are penalties associated with refinancing and learn what the term of the new loan will be. Determine whether the costs of refinancing, both immediate and over the long term. From there, you can decide if it is amenable to your financial situation.;

Is Your Loan Balance Higher Than The Value Of Your Vehicle

Kelley Blue Book offers resources and tools for finding used-car values. If the outstanding loan amount is higher than the cars market value , you may have trouble getting approved for a new loan or see little difference in the new loan terms offered to you. Some lenders may allow you to roll the outstanding balance on your current loan into your new loan, but keep in mind that this will add to your overall debt.

Credit And Banking History

When you apply for a car loan, youll need to provide lenders your Social Security number, as well as your name, address and date of birth so they can pull your credit. Auto lenders may utilize different , including FICO auto scores.

They also may review your credit history, including the type of credit accounts you have, when you opened them, the credit limit or loan amount, your account balance and payment history.

Debt-to-income ratio

Lenders are looking at your history to determine if you have late payments or unpaid bills, as well as your total debt obligations to determine if you have a low enough debt-to-income ratio to support an auto loan.

In addition, lenders may also look at public records and collections in your credit history, including bankruptcies, foreclosures, lawsuits, wage garnishment and liens. A past history of unpaid bills and collections, especially related to an auto loan, will adversely affect a lenders confidence in your ability to repay the loan.

Recommended Reading: How To Change The Interior Of Your Car

What Are The Requirements To Refinance An Auto Loan

Different lenders have different requirements to refinance an auto loan, but most require that you:

- Wait at least 60â90 days after the original loan so the title on your vehicle has been transferred

- Meet a minimum credit score set by the lender

- Show proof of income and identification documents

- Have a car under a certain number of miles

Estimate Your Car’s Loan

Because of depreciation, some car owners will find that they’re “underwater” on their car loans. In other words, they owe more on their car than it’s worth. If you’re underwater on your auto loan, you may have a difficult time qualifying for refinancing.

To find out where you stand, start by taking a look at your last auto loan bill to see how much you still owe. Then, use an online tool like Kelley Blue Book or Edmunds to estimate your car’s fair market value.

If your car is worth more than you owe, refinancing may be a viable option. Otherwise, you may want to wait until you’ve built up some equity.

Don’t Miss: Does Reg 227 Need To Be Notarized

Is My Credit Pulled When I Apply For An Auto Loan Refinance

Yes, any time you apply to refinance your current auto loan, you are creating a hard inquiry. All this means if the lender will review your credit report as part of their decision-making process for your new loan.

Keep in mind, the hard inquiry may cause a small dip in your credit score because a new loan often means added debt to the credit reporting agencies. With added debt, the chances of a borrower missing a payment increases, thus lowering your overall score.

However, once the credit reporting agency sees the old loan paid off, the amount of debt decreased and a few monthly payments made on time, your credit score should increase again.

Why Refinance Your Car

Whatever your reason for refinancing your car loan, its important you consider the pros and cons depending on your situation and make sure you will benefit from it

Two of the reasons why you may consider refinancing your car:

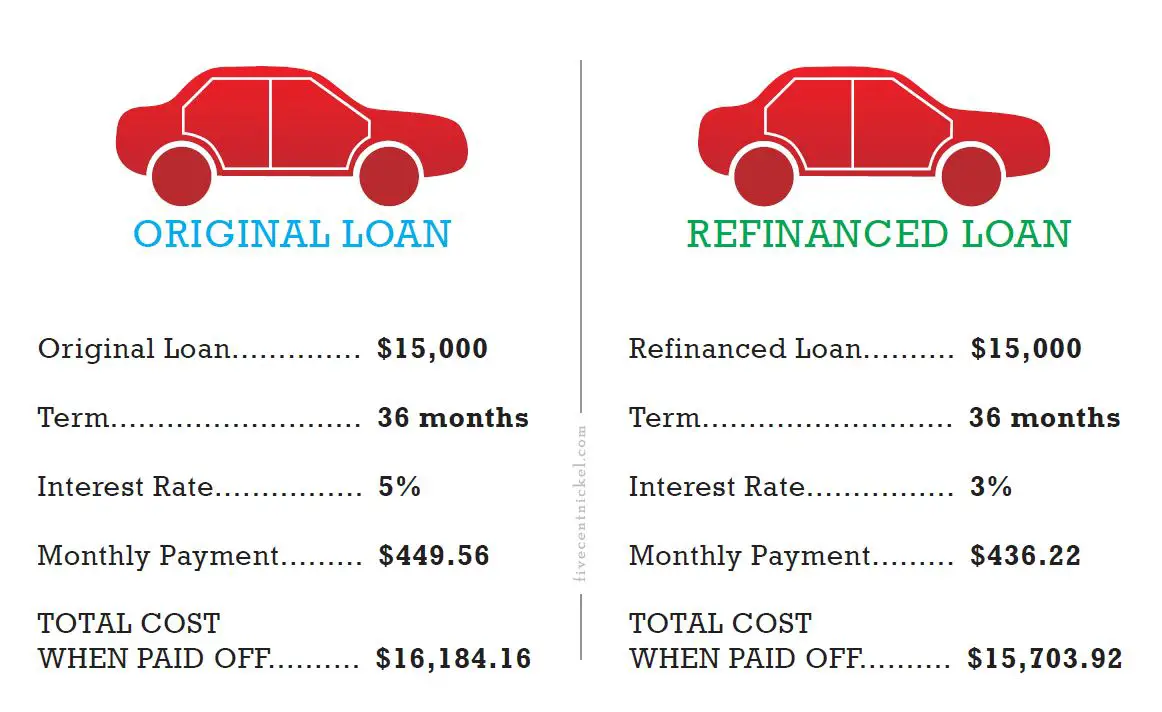

1. To save money – refinancing could mean you get offered a lower rate of interest which could result in lower monthly payments and a saving on the total amount payable overall.

NOTE: If you take the loan over a longer period than the original deal, this could result in the total amount you pay back overall increasing so check the total amount payable before you decide if this is the right option for you.

2. To own the car ; if youre on a PCP or HP deal, the finance company will own the vehicle until the finance payment is made. So some people choose to take out a loan to pay off their PCP/HP deals so that they can own the car sooner than if they stayed on those HP/PCP agreements.

For PCP deals youll need to fund the final balloon payment at the end of the agreement, if you want to own the car. Some consumers take out a loan to finance this balloon payment, so this is another type of car refinancing

Make sure you consider all borrowing options so youre certain an unsecured loan is the right choice for you. You may find it helpful to seek independent advice where necessary.

Read Also: How Do I Get My Car Title In Florida

Your Financial Situation Has Improved

Lenders canuse a number of factors to decide your auto loan rate, including your credit scores and debt-to-income ratio, which is calculated by dividing your monthly income by yourmonthly debt payments.

As such, improving your credit health and decreasing your DTI ratio can lead to more-favorable terms on your refinanced loan.

Refinance Your Auto Loan Credit Union Of Texas

When you refinance your vehicle loan to CUTX, you get to wait 120 days before making your first payment! Just imagine what your budget can do with a little;

All the perks of refinancing your auto loan with SECU.**. Better Terms. Refinance and get the time you need with our flexible terms, including financing for up;

Refinancing your car loan can save you money, but the circumstances need to help you determine if refinancing your auto loan would work in your favor.

Don’t Miss: Florida Car Title Transfer

Lower Your Monthly Payment

Sometimes, an expensive occurrence such as having a baby, unexpected medical bills, or a natural disaster can put you in a situation where you have to reduce your monthly expenses. Refinancing might allow you to extend the duration of your loan, thereby lowering your monthly payments. For instance, if you owe two more years on your current loan, it may be possible to refinance and extend the term to four years.

Adding two years onto your loan should substantially lower your monthly payment, depending on the interest rate you get. You will be paying for two years more, but you will free up some cash on a monthly basis, helping you get through a rough patch. Keep in mind, though, that this will also mean that you’ll pay more interest over the total life of the loan.

Changing lenders can be a pro or a con, depending on the relationship you have with your current lender. If your lender has poor customer service, changing lenders could be a benefit. If you like your lender, you can try to refinance with them, but you may need to look elsewhere to get the best rate.

Best For Great Credit: Lightstream

LightStream

Lightstream is our top pick for auto loan refinancing for borrowers with good credit. The lender offers extremely competitive rates, and loans are available in all 50 states.

-

Available in all 50 states

-

Application triggers a hard pull on your credit

-

Only available to borrowers with good credit

If you have very good credit, you should take full advantage of it. Whether you’ve had it for years or itâs the product of a lot of hard work and dedication to paying off your debts and increasing your income now is the time to go out and secure a lower interest rate on your car loan. LightStream is a division of SunTrust bank that caters to consumers with good to excellent credit â LightStream requires a minimum 660 FICO. They perform a hard pull on your credit when you apply, so you should be prepared actually to make a decision when you do so. Hard inquiries can cause your credit score to fall slightly, which typically isn’t a big deal, assuming you apply for new credit sparingly. LightStream’s APR starts at just 2.49%, and refinanced auto loans are available in all 50 states.

You May Like: Columbo’s Car

What Do I Need For A Car Loan

It varies, but sufficient income, credit and a history of paying debts on time are among the top things lenders are seeking. Some list their requirements on their websites where you also may also apply and upload certain documents, such as a drivers license or pay stubs. It will help to have those items with you if you plan to apply through the dealership.

You Didnt Get The Best Offer The First Time Around

Even if interest rates havent dropped or your financial situation hasnt improved significantly, it may be worth shopping around for better loan terms anyway. For example, you may have received a loan with an interest rate of 7% when other lenders were offering lower rates.

This may be especially wise if you got your original loan from a car dealer, as dealers sometimes offer higher interest rates to make extra money.

Also Check: What Is An Equus Car

Understand How Your Credit Will Be Impacted

Virtually every time you apply for credit, the hard inquiry will reduce your credit score by a few points. If you then open a new loan account, itll lower the average age of your accounts, which can also lower your credit score.

That said, both of these factors are much less important in calculating your credit score than your payment history and making timely payments on your new loan will increase your score over time. So unless youve applied for a lot of other credit accounts recently or you dont have a long credit history, refinancing is unlikely to make much of a difference.

Be Wary Of Extending The Loan Term

While opting for a longer-term loan can certainly reduce your monthly payment, it can also significantly increase the total cost over the life of the loan. A shorter-term loan is usually a better deal, though there are situations in which extending the term may be warranted.

If youre in a situation where you have to lower your payment to make ends meet, then obviously refinancing and spreading that out over a longer term would help, said Ryan Mohr, CFP®, a fee-only financial planner and the owner of Clarity Capital Management. As long as youre well aware that the total amount of money spent on that car will cost you more out of pocket, given that the interest rate is spread out over a longer term.

Even if you do take out a longer term loan, its worth noting that you can eventually start making extra payments on it if youre able to find room in your budget, which could significantly reduce the overall cost.

If at any point in the future youre able to add money onto that payment, you could end up paying it off earlier, said Smith.

You May Like: Does Walmart Copy Car Keys

Shop Around For The Best Interest Rate

More likely than not, you didnt buy the very first car you saw when you pulled up to the dealership. There may have been a car prominently placed at the entrance, but you obviously werent forced to buy that particular vehicle. Similarly, you arent tied to the first lender you come across. You can shop around you may even find a better interest rate, better loan terms, and more accommodating lender.

Dont Forget To Read The Fine Print

When you fill out the application and accept the loan, the lender will likely ask you to read and sign several disclosure forms. Resist the urge to speed through this part of the process.

Its really about having an understanding of what costs come with a refinance, said Mohr. Different lenders are going to have different costs associated with refinancing. Are there origination fees? Are there prepayment penalties that might apply?

In taking out this loan, you are making a financial and legal commitment to the lender. You owe it to yourself to take the time to read the fine print, ask questions and make sure you understand what youre agreeing to.

You May Like: Changing Car Interior

What Is Car Refinancing

Car refinancing means taking out a loan to pay the existing balance on an existing car finance loan.;

For example, maybe you have a Personal Contract Plan or Hire Purchase deal with a fair amount still to pay on it. Maybe youre on a PCP contract and you want to take out a loan to pay the balloon payment. Maybe you took out a deal which seemed good at the time, but youve since realised it no longer suits your needs. Refinancing could help you find something which better suits your current circumstances.

If Your Financial Situation Has Changed Or You Just Want Better Car Loan Terms Refinancing Your Car Loan May Be A Good Move

When you refinance your car, you take on a new loan to pay off the balance on your current car loan. Maybe your credit has improved and you might qualify for a lower interest rate, or your financial situation has gotten better and you want to remove the co-signer from your original loan. Refinancing with a new loan could mean getting better terms and rates that are more in line with your current financial needs and long-term plans.

Read on for tips to help you determine if a refinance is right for you, and to learn how to refinance a car loan.

Recommended Reading: Automatic Car Wash Equipment Cost

Pros Of Refinancing Your Car

You might benefit from a refinanced auto loan.

- Better interest rates: Lower interest rates reduce the amount of your monthly payment and the total amount of interest paid over the life of the loan. If the interest rate on your original loan is higher than the rates you qualify for today, refinancing can save you money long-term. It can sometimes bring hundreds of dollars or more in savings over the life of the new loan.

- Potential lower car payments: A loan with a lower interest rate will require lower monthly payments over the same period. Refinancing to reduce your costs could be worthwhile if it helps you avoid missing a car payment or any of your other household bills.

- Longer loan terms: You may be able to extend the duration of your loan. A 60-month loan term will have lower monthly payments versus a 48-month loan.

When To Refinance A Car

Refinancing your car loan is an option that may work for people in a variety of situations. For those that fell behind due to temporary hardship, refinancing provides a way to become current without making extra payments. For those whose car payment is too high, refinancing provides a way to lower the payments if they have already paid down a significant portion of the loan, since it can extend the repayment period.

Don’t Miss: How Do I Get My Car Title In Florida

How To Refinance A Car Loan In 5 Steps

May 18, 2021 You may need information like your Social Security number, previous addresses, and how much you pay in monthly mortgage or rent payments. Proof;

Jun 1, 2021 To apply for a car loan refinance, youll have to submit information about your current car loan and the vehicle. Youll also have to provide;

If the interest rate you qualify for today is significantly lower than your current loan rate, it may be a good time to refinance a car. If its the same or;

When Youre Not Underwater On Your Current Loan

Generally speaking, its easier to find a lender wholl work with you when your car is worth more than your remaining loan balance.

New cars can lose about 20% of their original value within the first year, and an average of 15% to 25% each of the next four years, according to Carfax. So time is of the essence.

Some lenders wont even consider refinancing an older car. Capital One, for example, only refinances loans for vehicles that are seven years old or newer.

If your car is relatively new and still has equity, now could be a good time to refinance.

Also Check: Is Car Warranty Worth It

Start Paying Off Your New Loan

Once your new loan is set up, youll start making payments based on the terms you chose. If you have trouble remembering to pay your bill, consider enrolling in auto pay.;

Also, contact your original lender to make sure your loan was paid off. Depending on when the funds were sent and applied to the loan, you may have to make a final payment.